Invoice Basics

/You don't work for free. In addition to all the other tasks that the sigerTax property tax software makes more efficient, sigerTax can help with invoicing your customers as well.

Typically you would create an invoice for a client, add line-items to the invoice, and mail it out. This always leaves the questions "Has everything been invoiced? Did I forget anything?" Through sigerTax, the line items (Invoice Items) are created as individual pieces which are then used to calculate and create invoices. This allows you to view the possible billable items and then decide what to include on your invoices. We also offer an even more powerful tool to be used in the creation of Invoice Items - Invoice Terms.

In addition to creating the invoice, the software also allows you to create an invoice template (Invoice Terms) for each client which includes line items which define the template (Invoice Term Items) and a list of properties the template will handle. As properties are added to this list, Invoice Items are created automatically. These change status from pending to billable as the billing event defined on the template occurs. Flat Fee billing events are usually a date, while Contingency billing events are usually the value settlement. You can process these invoice items as often as you like, which groups them on invoices according to the terms (either individually, per property, or all on one invoice per client).

There are three major components of the sigerTax Invoicing method:

- Invoice Items

- Invoices

- Invoice Terms

While the information below is a brief overview of each section, full descriptions can be found in the sigerTax Help.

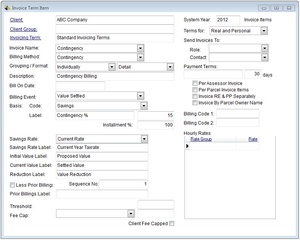

Invoice Items

The Invoice Item is an individual unit that is billable on an invoice. It can be as specific as a line item for one level of one parcel’s appeal, or as general as the flat fee for working an entire portfolio. Invoice Items can be found with shortcuts at the Client level, the Client Group level, and the Property level or through the Invoice Item Search. Invoice Items can also be created automatically through Invoice Terms, which are discussed below.

The Invoice Item screen includes the basic information that the system needs to calculate the invoice amount (e.g. Contingency Rate, or Flat Fee Amount). It also includes optional, more complex settings that you can use to adjust how the item is calculated (e.g. applying caps, adjusting for prior billing, etc.) and/or how the information is displayed on the invoice (e.g. changing the value labels, or billing terms). In addition, there are settings that allow you to decide how to group the invoice items on the created invoices, either individually or by client.

amount (e.g. Contingency Rate, or Flat Fee Amount). It also includes optional, more complex settings that you can use to adjust how the item is calculated (e.g. applying caps, adjusting for prior billing, etc.) and/or how the information is displayed on the invoice (e.g. changing the value labels, or billing terms). In addition, there are settings that allow you to decide how to group the invoice items on the created invoices, either individually or by client.

You can use the shortcut buttons on the invoice item to invoice the item (if it is billable), calculate an invoice’s amount based on its type, or force the contingency amount based on the current savings (rather than waiting for a settled value).

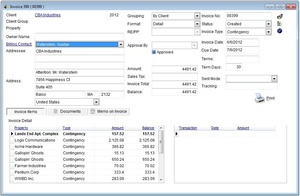

Invoices

The Invoice is an itemized bill of services rendered to the Client. Within sigerTax Invoices are the record that groups and summarizes Invoice Items. Invoices can be found at the Client level, the Client Group level or through the Invoice Search.

When you create an Invoice, the information included on the Invoice Items is calculated, and most fields can fill in automatically if utilizing the Invoice Term feature. From here, you can print the invoice out and it is ready to be sent. The Invoice also includes the default addressee as well as a list of Invoice Items that are linked to the invoice itself. You can also attach external documents to the invoice, and even include memo text on the printed invoice.

can fill in automatically if utilizing the Invoice Term feature. From here, you can print the invoice out and it is ready to be sent. The Invoice also includes the default addressee as well as a list of Invoice Items that are linked to the invoice itself. You can also attach external documents to the invoice, and even include memo text on the printed invoice.

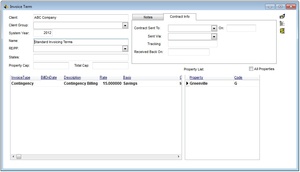

Invoice Terms

An Invoice Term is a template from which invoice items can be created automatically for a client. The Invoice Terms are not a required piece, but can save a great deal of time when creating invoice items with identical parameters. For example, a client may have one contingency percentage for all of their real estate properties and one for their personal property properties. By creating an Invoice Term for the client for each type of property, you can automatically generate invoice items for each type of property with the correct contingency amount, avoiding manual entry of each one.

The information on the Invoice Term is basic, focusing on the outline of the term itself. It includes the name of the term and states to which the term applies as well as contract information and notes. The Invoice Term Items define the actual behavior for each invoice type, while the Property List defines which properties are included.

name of the term and states to which the term applies as well as contract information and notes. The Invoice Term Items define the actual behavior for each invoice type, while the Property List defines which properties are included.

Invoice Term Items

As an Invoice Item relates to the larger Invoice, the Invoice Term Item has the same relationship with the Invoice Term. The choices made on the Invoice Term Item determine what is set on the automatically generated Invoice Item. These are the same choices detailed above, but will affect any invoice item generated from the template, rather than any one specific invoice item. It is important to create and save Invoice Term Items on the Invoice Term before adding properties to the property list, as that addition is what automatically generates the Invoice Items.

the Invoice Term. The choices made on the Invoice Term Item determine what is set on the automatically generated Invoice Item. These are the same choices detailed above, but will affect any invoice item generated from the template, rather than any one specific invoice item. It is important to create and save Invoice Term Items on the Invoice Term before adding properties to the property list, as that addition is what automatically generates the Invoice Items.

In addition to all of the features above, you can also use the Invoicing feature to simply calculate the correct invoice amounts, and then upload that information to QuickBooks. We are happy to help you implement this feature that has saved our clients so much time and effort over the years. Even if you would like to just discuss your current invoicing process and best practices, we would be happy to help with that as well.