Featured Report: Tax Bill Log

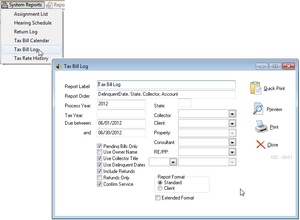

/Which Tax Bills are due? When are the Tax Bills due? Rather than searching for these answers client by client, the Tax Bill Log enables you to quickly generate a report of every tax bill within the system matching the designated criteria. This report is available through the System Reports menu, which is accessible at any level of the system. You can use the drop-down options and checkboxes like the ones described below to narrow down the tax bills included on the report. Full descriptions of the report's criteria options are available in the sigerTax Help.

-

Types: the type criteria allow you to decide which categories of tax bills you wish to include on the report. For example, you can include only 'Pending' bills or only 'Refund' bills.

-

Information: the information criteria allow you to designate how much detail to include on the report. For example, you could select to only include the tax bills for the state of Texas, or to use the owner name of the parcels, rather than the client name.

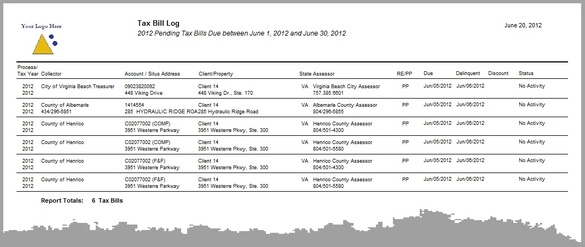

The Tax Bill Log report will open after the [Preview] button is clicked on the Tax Bill Log screen. The report includes the requested tax bill information such as the account number of the parcel, the due date, and the status of the tax bill, to name a few.